b&o tax states

Marketplace facilitators such as Amazon typically collect sales tax at the retail sales rate which ranges from 7 to 105 depending on location and industry. Slaughtering Breaking and Processing Perishable Meat.

Has more than 100000 in combined gross receipts sourced or attributed to Washington.

. 2020 a 20 increase to Washington states business and occupation BO tax goes into effect increasing the tax burden on health care providers including independent. For products manufactured and sold in Washington a business owner is subject to both the Manufacturing BO Tax and the Wholesaling or Retailing BO Tax. If youre unsure how your business is classified the Department of Revenue provides a list of common business activities and their corresponding tax classification s.

A one-time 4000 city. Extracting Timber Extracting for Hire Timber003424. Washington unlike many other states does not have an income tax.

Commercial Parking Business BIMC 510. Unlike the retail sales tax a sale does not have to occur for a. The state BO tax is a gross receipts tax.

Business and Occupation Tax. Heres how the state BO works. Have a local BO tax.

States of Washington West Virginia and as of 2010 Ohio and by municipal governments in West Virginia and Kentucky. Kenmores BO tax applies to heavy manufacturing only. Not at all say business owners.

Delaware Nevada Ohio Oregon Tennessee Texas and Washington. Businesses with 150000 or more in revenues attributable to Ohio are responsible for paying Ohio Gross Receipts Tax Commercial Activity Tax either annually or quarterly. A Washington State superior court granted summary judgment for banking associations holding that the states additional 12 business and occupation BO tax imposed on certain financial institutions violates the Commerce Clause of the US.

While deductions are not permitted for labor materials or other overhead expenses the State of Washi. Retailers engaged in business in California must register with the California Department of Tax and Fee Administration CDTFA and pay the states sales tax which applies to all retail sales of goods and merchandise except those sales specifically exempted by law. Out-of-state taxpayers earning apportionable income attributable to Washington are required to apportion their revenue and report to Washington.

The business and occupation tax often abbreviated as BO tax or BO tax is a type of tax levied by the US. First enacted as a temporary funding mechanism in 1933 it has been amended tweaked and updated to include hundreds of exemptions exceptions and classifications. This article authored by Scott Schiefelbein and Robert Wood 2 provides helpful tips regarding some of the nexus traps the BO tax poses for the unwary company seeking to do business in Washington and was originally published in the spring issue of the Oregon State Bar Taxation Section Newsletter.

While deductions are not permitted for labor materials or other. The Manufacturing BO tax rate is 0484 percent 000484 of your gross receipts. The state does not exempt marketplace facilitators from collecting and remitting sales tax in addition to the BO tax.

The major classifications and tax rates are. The relationship between the state BO tax and the local BO taxes is similar at least in concept to the sales tax. Constitution because it discriminates against out-of-state financial institutions.

A one-time 4000 city. Contact the city directly for specific information or other business licenses or taxes that may apply. So for example if you pay ServiceOther B O annually and your annual business income is 56000 this gross income is tax-free.

The Manufacturing BO tax rate is 0484 percent 000484 of your gross receipts. Business and occupation tax overview. Athletic Exhibitions BIMC 505090Casual and Isolated Sales.

Bo tax states Wednesday May 18 2022 Edit. The state BO tax is a gross receipts tax. Unlike the retail sales tax a sale does not have to occur for a.

Definitions for each BO tax classification are listed below. But service businesses pay a 15 rate. Businesses Exempt from City BO Tax - BIMC 388 505090 508 states that the Citys BO Tax does not apply to certain business activities to which tax liability is imposed by other meansBusiness activities not subject to BO Tax are.

BO also does not consider income or loss offers no deduction for cost of. B Amp O Tax Guide City Of Bellevue Come to New York where you can pay the second. The state BO tax is a gross receipts tax.

The Washington BO tax is a gross receipts tax applied on property and services sourced to Washington most comparable to the Ohio or Oregon Corporate Activity Tax CAT. The department assigns a reporting frequency for filing returns based on estimated yearly tax due and type of business. Business registration is done through the State of Washington Business Licensing Service.

And 39 cities in the stateincluding Seattlehave gotten in on the action imposing their own versions of the BO on top of the state tax. V voter approved increase above statutory limit e rate higher than statutory limit because rate was effective prior to January 1 1982 ie grandfathered. Manufacturing Wheat into Flour.

In business in California must register with the California Department of Tax and Fee Administration CDTFA and pay the states sales tax which applies to all retail sales of goods and merchandise except those sales specifically exempted by law. As your income goes up you get a smaller and smaller credit until you make enough to pay the full percentage. The Washington State Supreme Court today September 30 2021 upheld the constitutionality of the states business and occupation BO tax surcharge imposed on certain financial institutions.

Washington has a gross receipts tax. The nexus determination for sales tax is similar to the BO. Business and Occupation Tax.

However your business may qualify for certain exemptions deductions or credits. Bo tax states Tuesday May 3 2022 Edit. This means there are no deductions from the BO tax for labor.

The Washington BO tax is a gross receipts tax applied on property and services sourced to Washington most comparable to the Ohio or Oregon Corporate Activity Tax CAT. The BO tax rate is 0275 percent. International Charter Freight Brokers.

Both Washington and Tacomas BO tax are calculated on. Service and Other Activities. Washington unlike many other states does not have an income tax.

The use tax generally applies to the storage use or other consumption in California of goods purchased from. Use these definitions to determine which classifications under which you need to report business income on the excise tax return. The state BO tax is reported on the Department of Revenues excise tax return.

It is a type of gross receipts tax because it is levied on gross income rather than net income. Washingtons BO is an excise tax. It is measured on the value of products gross proceeds of sale or gross income of the business.

Extracting Extracting for Hire00484. May 13 2020. Washington has a state sales tax rate of 65 which is collected on all retail sales across the state.

A business will be required to report on a monthly quarterly or annual basis. The first 1000000 in taxable gross receipts are taxed at 150 minimum tax due and any gross receipts above that are taxed at 026. The tax amount is based on the value of the manufactured products or by-products.

The BO tax for labor materials taxes or other costs of doing business. A Business and Occupation Tax is imposed on any persons s engaging or continuing with the state in any public service or utility business except railroad railroad car express pipeline telephone and telegraph companies water carriers by steamboat or steamship and motor carriers. On top of that state rate.

Soybean Canola Processing00138. If you make 122000 or. FAR part 145 certificated repair station that is engaging within this state in the business of making sales at retail that are exempt from the tax.

Washingtons BO tax is calculated on the gross income from activities.

Washington Business And Occupation Tax Does Not Need Physical Presence For Nexus

Why Our B O Tax Is Unfair R Seattlewa

Explained Business And Occupation Taxes At The Local Level The Doty Group Cpas Tax Assurance Accounting Litigation And Valuation

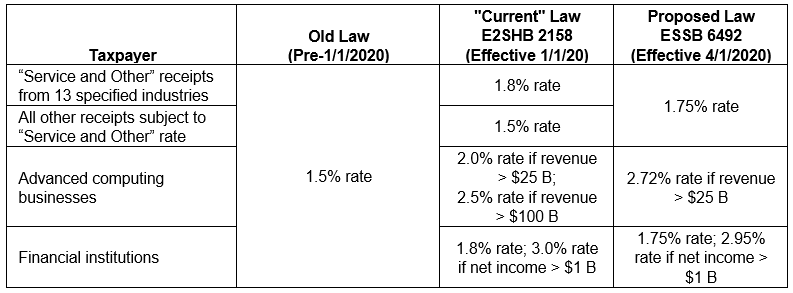

Changes To Washington S B O Tax Economic Nexus Standard And Use Tax Notice And Reporting The Cpa Journal

50 First B O Passenger Diesel Painted For Abraham Lincoln Service On Subsidiary Chicago Alton Baltimore And Ohio Railroad Alton Model Trains

When Are Business Occupation B O Taxes Due

When Are Washington S Business Occupation B O Taxes Due 2021 Youtube

Business And Occupation B O Tax Washington State And City Of Bellingham

Wv Cities Worry About B O Tax Cuts

747 8f Rollout Of Everett Factory Boeing Aviation Blog Aviation Mechanic

World S Largest Airplane Photographic Print Allposters Com In 2021 Boeing 747 Boeing World

B O Tax Program Puyallup Main Street Association

Washington Department Of Revenue Delays Implementation Of New B O Tax Surcharges Service Rate Increase Coming Instead Perspectives Reed Smith Llp