are hearing aids tax deductible in australia

Only medically required equipment is eligible to be deducted. The net medical expenses tax offset is no longer available from 1 July 2019.

Are Hearing Aids Tax Deductible Sound Relief Hearing Center

Forum chair David Brady has called on all political parties to commit to the change ahead of the July 2 Federal Election so people who are deaf or have hearing loss can continue to work support their families and help build the.

. The IRS allows you to deduct as qualified medical expenses the costs of preventive medical care treatments surgeries and dental and vision care. Wheelchairs hearing aids spectacles artificial limbs and similar appliances used by persons in carrying out the duties of an employment are not allowable. Tax offsets are means-tested for people on a higher income.

If you use the standard deduction you cannot deduct any medical expenses. We are a deductible gift recipient and donations to the Victorian Deaf Society are tax. Hearing aids like most medical expenses are sometimes tax-deductible reducing the overall outlay.

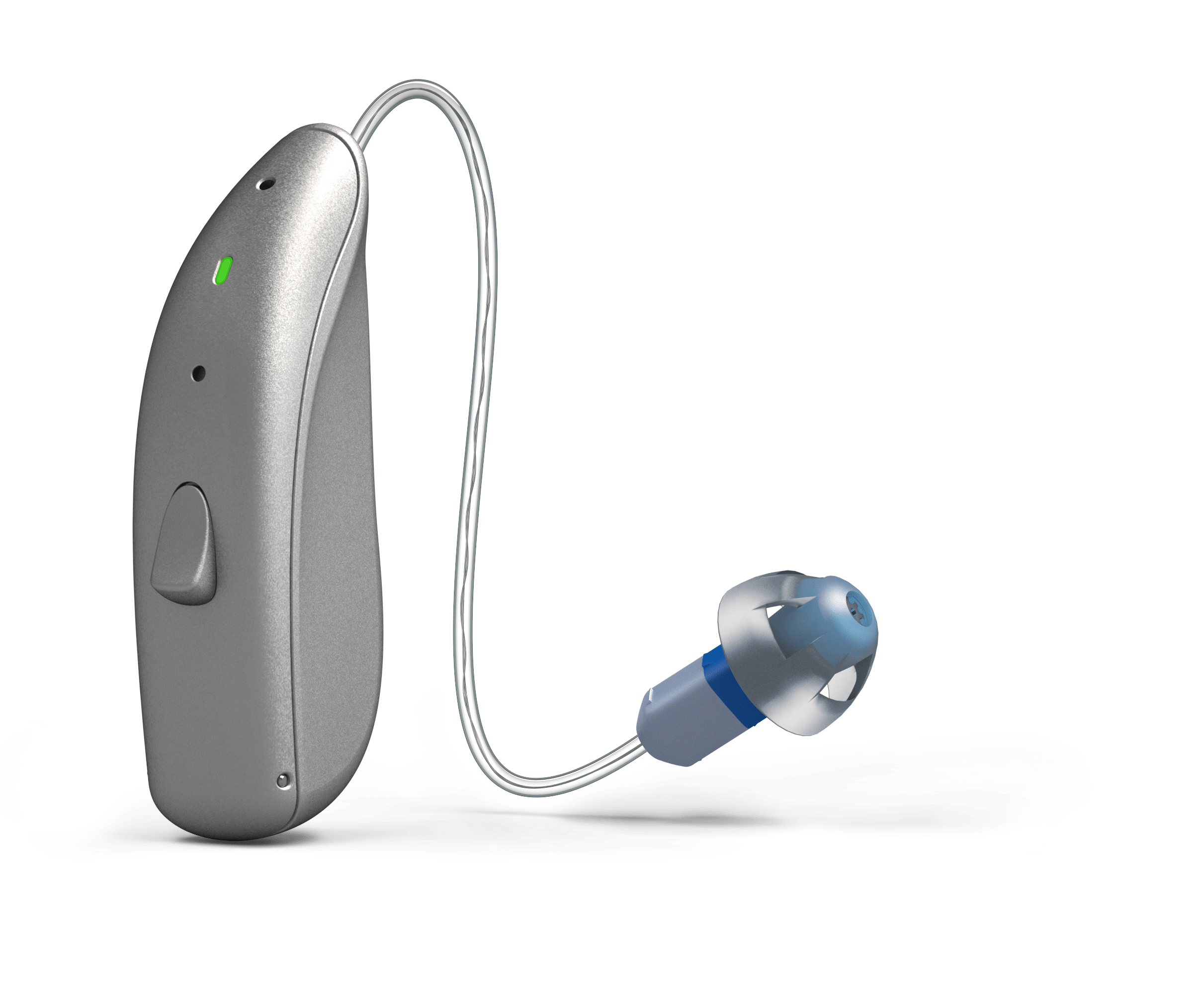

You will then be sent a welcome pack to the program. Turbo tax a popular tax preparation software also ensure that hearing aids are tax-deductible. Allowable deductions for hearing loss In the case of hearing loss allowable deductions include any payments you made for your diagnosis and treatment which include what you paid for your hearing aids.

Claims for this offset are restricted to net eligible expenses for. The standard deductions for 2019 are. Yes hearing aids are tax-deductible.

However as you will find with many tax-related subjects the deduction status of hearing aids can also be rather complicated. Unfortunately the ATO regards the cost of such devices as private in nature since they are primarily intended to improve the health and wellbeing of. You may still be eligible for this offset for income years from 201516 to 201819.

For your hearing aids and hearing aid accessories to be tax-deductible you need to meet certain criteria. The Hearing Aid Project is another nonprofit that welcomes used hearing aids. Single - 12200 add 1650 if age 65 or older add.

You can only deduct medical expenses if you itemize your deductions. Tax refunds within 10 to 14 days from lodgement subject to ATO processing. This means that if you need to wear a hearing aid just for your job for instance you work in a noisy environment and need.

Dont forget the VAT can be reclaimed if the business is VAT registered. Prescription drugs and devices such as eyeglasses contact lenses dentures and hearing aids are also deductible. In spite of this a new tax law allows taxpayers to deduct up to 8000 for health care expenses.

In the next two years they will receive 5 of their income. You can have behind-the-ear in-the-ear or other models all put to good use. This can be online and in many cases an application only takes a few minutes.

Depending on how much you spent on dental treatments during the previous tax year you may be eligible to claim a tax offset from the Australian Taxation Office ATO. In many cases hearing aids are tax-deductible. For tax deductible hearing aids consider the following costs.

Already mentioned Lions Club Hearing Aid Recycling is a popular nonprofit that accepts hearing aids and redistributes them in a meaningful way. Amount you can claim. The group recycles repairs and modifies.

It includes hearing aid also. Tax deductible hearing aids. For employees hearing aids or similar disability equipment provided by companies will qualify for full corporate tax relief without incurring any additional tax for that staff member.

Accordingly claims for income tax deductions under sub-sections 511 531 and 541 in respect of expenses incurred on medical appliances eg. Medical expenses tax offset. By deducting the cost of hearing aids from their taxable income wearers could reduce the cost of their hearing aids by up to 35.

Income tax rebates for hearing aids If you earn an income and pay income tax you will be able to claim a tax offset for out-of-pocket costs on hearing aids expenses after other subsidies government reimbursements and insurance fund benefits. Hearing aids batteries maintenance costs and repairs are all deductible. Once you determine whether you are eligible you then must apply for a voucher which can be used to redeem subsidised hearing services.

The exception to this rule are taxpayers who have out-of-pocket medical expenses relating to disability aids attendant care or aged care expenses until 1 July 2019. Expression Australia is a registered charity under our legal name Victorian Deaf Society ABN 56 004 058 084. Income tax rebate for hearing aids The good news is that if you have an income and pay income tax you can claim a tax offset for any out-of-pocket costs on your hearing aids.

Even the hearing aid batteries are tax-deductible. Other hearing assistance items that are deductible include televisions and related accessories that amplify sound guide dogs including veterinary grooming and food expenses particular smoke detectors doorbells and burglar alarms captioned phones and teleprinters. You can also deduct visits to psychologists and psychiatrists.

The rules state that if your hearing aids are to be used entirely for your business you can apply for tax relief from them. If you are unable to apply online you can call Hearing Choices on 1300 848. They come under the category of medical expenses.

Urgent changes are needed to tax rules to allow hearing aids to be claimed as a workplace deduction the Deafness Forum of Australia says. As one of Melbournes longest established providers of hearing aids Expression Audiology fits and services all the leading brands. Affordable fixed price fee which is completely tax deductible.

According to the Internal Revenue Service the taxpayers can deduct various kinds of medical expenses. Any hearing aids or accessories you purchased within the past year are eligible for a tax credit so long as it is not reimbursed by your private health insurance companyLine 330 of your tax return when filling out the forms will list all of your out-of-pocket expenses. Oes that are tax deductible include.

Deducting the cost of hearing aids from your taxable income can lower the amount you pay for hearing aids by as much as 35 percent. While that may not add up to much by itself it may be a significant factor when combined with your familys other medical and dental expenses. A battery to power hearing aids.

Safe secure ATO-approved website that is operated with absolute integrity. Are Hearing Aid Batteries Tax-Deductible.

Are Medical Expenses Tax Deductible

Simple Spreadsheets To Keep Track Of Business Income And Expenses For Tax Time Etsy Shop Critique Organization Planner Printables Spreadsheet Template

Are Hearing Aids Tax Deductible In Australia Ictsd Org

Are Hearing Aids Tax Deductible In Canada Ictsd Org

9 Ways To Maximise Income Tax Relief For Family Caregivers In 2022 Homage Malaysia

Are Hearing Aids Tax Deductible Sound Relief Hearing Center

Tips For Affording Hearing Aids Bose

Discounts And Free Services For Seniors And Their Caregivers Senior Discounts Senior Citizen Caregiver

Are Hearing Aids Tax Deductible What You Should Know

Are Hearing Aids Tax Deductible What You Should Know

Are Medical Expenses Tax Deductible

Notary Tip How To Be Prepared For Signers With Special Needs Notary Notary Public Business Notary Public

Are Hearing Aids Tax Deductible Sound Relief Hearing Center

Income Tax Rebates For Hearing Aids My Hearing Centre

![]()

Are Hearing Aids Tax Deductible Earpros Au

Ceo Cfo Executive Resume Example Executive Resume Resume Examples Resume References

Are Hearing Aids Tax Deductible Sound Relief Hearing Center

Who Pays More In Taxes U S Vs Europe Developed Countries Money